Us payroll tax calculator 2023

It will be updated with 2023 tax year data as soon the data is available from the IRS. The gov means its official.

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

If you specified an annual gross salary the amount entered in the.

. When you file your 2022 federal income tax return in 2023 attach Schedule H Form 1040 to your Form 1040 1040-SR 1040-NR 1040-SS or 1041. Free 2022 Employee Payroll Deductions Calculator. The IRS announced that they will be providing Covid tax relief for certain 2019 and 2020 Returns due to the pandemic.

Sage Income Tax Calculator. 4 or in a numeric format eg. Reasonable travel allowance rates.

The IRS will be issuing refunds of up to 12 billion to a total of 16 million qualifying individual taxpayers Form 1040 and businesses Form 1120 who filed their 2019 or 2020 taxes late. Calculate how tax changes will affect your pocket. The Social Security tax rates from 19372010 can be accessed on the Social Security Administrations website.

Do you need access to a database of state or local sales tax rates. May not be combined with other offers. Payroll Tax Western Australia This is general information and not advice.

Super contribution caps 2021 - 2022 - 2023. Social Security. In 20112012 it temporarily dropped to 1330 565 paid by the employee and 765 paid by the employer.

Student Loan repayments and pension contributions can both alter the amount you take home or what you have to pay as an employer. The current threshold is 13 million in annual Australian taxable wages. Understanding the Australian Income Tax System.

For more information see WA Department of Finance. Use this simplified payroll deductions calculator to help you determine your net paycheck. In the Australia Tax Calculator contact us if you would like to have additional calculations for Superannuation factored in to this tool or.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Its so easy to use. Learn More About Income Taxes.

Offer period March 1 25 2018 at participating offices only. As a result many taxpayers are unaware of the true amount they pay in payroll taxes. This calculator is integrated with a W-4 Form Tax withholding feature.

Federal government websites often end in gov or mil. The online calculator is a straightforward ready reckoner that doesnt take into account other deductions which might apply. Add these household employment taxes to your income tax.

For more specific guidance check out our Payroll services. If your annual Australian taxable wages are less than 13 million you may not have to pay payroll tax but you might still need to register for payroll tax. This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts.

TAX DAY IS APRIL 17th - There are 215 days left until taxes are due. 2022 Atlanta Braves MLB playroll with player contracts options and future payroll commitments. Income and Payroll Reporting.

For example if 80 per cent of your total wages are paid in NSW youre entitled to 80 per cent of the. These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site. TAX DAY IS APRIL 17th - There are 215 days.

To qualify tax return must be paid for and filed during this period. The 2023 tax calculator is designed to provide quick income tax calculations and salary examples. Tax rates 2022-23 calculator.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. They help us to know which pages are the most and least popular and see how visitors move around the site. Eligible customers may be entitled to a 50 per cent reduction in their payroll tax for the 202122 financial year when they lodge their 2022 Annual Payroll Tax Reconciliation online.

The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. Note When entering pension in a numeric format please use the same frequency as you used to enter your gross salary. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. How Marginal Tax Brackets Work. HECSHELP loan repayment rates.

If you pay wages in another Australian state or territory the threshold is calculated as a proportion equal to the ratio of NSW wages to total Australian wages. If you are a member of a group of employers the 13 million threshold is calculated on the group members combined annual Australian taxable wages. Our free online Missouri sales tax calculator calculates exact sales tax by state county city or ZIP code.

Download the Missouri Sales. These cookies allow us to count visits and traffic sources so we can measure and improve the performance of our site. PensionIf you currently have a pension enter the amount that you pay into the pension on a regular basisThis can be entered in a percentage format eg.

The payroll tax rate reverted to 545 on 1 July 2022. Before sharing sensitive information make sure youre on a federal government site. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

2023 Tax Threshold 233000000. Braves Luxury Tax Payroll. The combined tax rate of these two federal programs is 1530 765 paid by the employee and 765 paid by the employer.

See information about calculating your payroll tax or use our payroll tax calculator. IT is Income Taxes. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID.

It remains in place for the 2022 to 2023 tax. Start filing your tax return now. They help us to know which pages are the most and least popular and see how visitors move around the site.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale that gradually increases the tax rate to a maximum of 65 for employers or groups of employers with annual taxable wages in Australia of more than 1 million. 2023 Tax Threshold 233000000. Use Schedule H to figure your total household employment taxes social security Medicare FUTA and withheld federal income.

Register now to payroll your benefits from 6 April 2023. Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return. Red Sox Luxury Tax Payroll.

A business pays wages liable to payroll tax in another state or territory. Important IRS penalty relief update from August 26 2022. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Youll no longer need to submit a P11D for each employee for whom you payroll benefits. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. Start filing your tax return now.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year. The payroll tax consists of two halves - one half is paid by the employee and one half is paid by.

How To Calculate Your Federal Income Tax Refund Tax Rates Org

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

Page Not Found Isle Of Man Isle Quiet Beach

Manage Your Distribution Wholesale Billing By Marg Pharma Software Pharmacy Software Pharmacy Fun Pharmacy

Income Tax Calculator For The A Y 2023 24 F Y 2022 23 With Free Excel Sheet Youtube

What S In Your Pantry Pantry Inventory Printable Checklist Pantry Inventory Pantry Inventory Printable Pantry Inventory Sheet

Supremecapitalgroup On Twitter Personal Financial Management Financial Institutions Financial Management

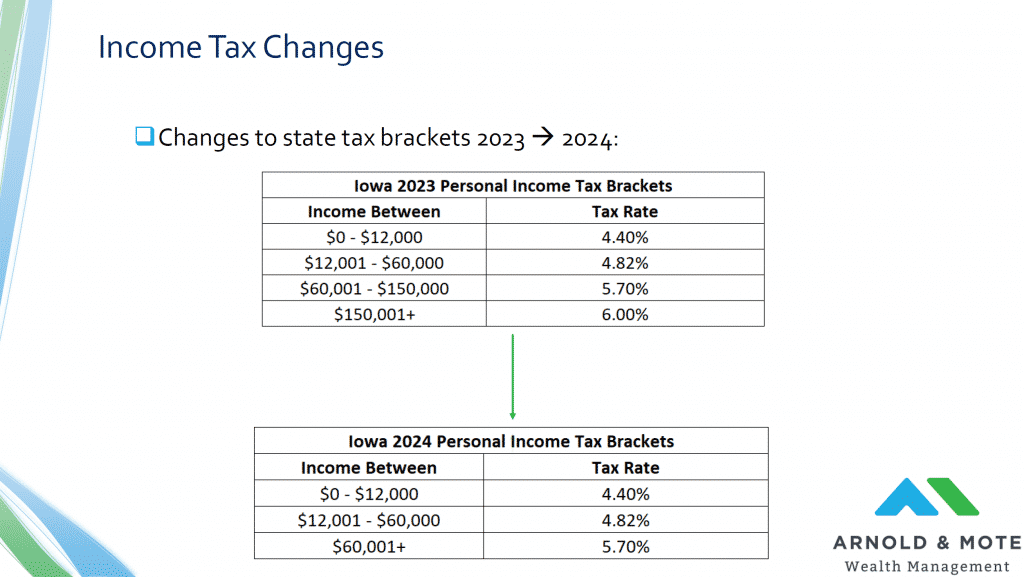

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Download Rental Property Management Excel Template Exceldatapro Rental Property Management Property Management Excel Templates

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Business Operating Budget Template Operating Budget Template Operating Budget Template What To Know About I Budget Template Free Budget Template Budgeting

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

Selecting Stock Photos Royalty Free Images Vectors Video Diseno Curriculum Como Hacer Un Curriculum Curriculum

Nanny Tax Payroll Calculator Gtm Payroll Services